§ M4 MADE WHOLE*

§ M4:1. In general

Although there is little California case authority regarding the status of an insurer’s subrogation rights when the insurer foregoes participating in the underlying action, the weight of out-of-state case authority supports the proposition that, in some circumstances, the insurer may recover funds paid to the insured by a legally responsible third party, even though the insurer did not participate in the insured’s legal action against the third party. [Hodge v. Kirkpatrick Development, Inc., 130 Cal. App. 4th 540, 553, 30 Cal. Rptr. 3d 303 (4th Dist. 2005); Plut v. Fireman’s Fund Ins. Co., 85 Cal. App. 4th 98, 104, 102 Cal. Rptr. 2d 36 (2d Dist. 2000)] See § O12 OFFSITE.

It is a general equitable principle of insurance law that, absent an agreement to the contrary, an insurance company may not enforce a right to subrogation until the insured has been fully compensated for his or her injuries, that is, has been made whole. Thus, absent the right to intervene, the insurer is to a large extent at the mercy of its insured’s efforts and success in recovering from the responsible third party. [Hodge v. Kirkpatrick Development Inc.] See § S105 SUBROGATION (PROPERTY POLICY) [Six essential elements of equitable subrogation].

§ M4:2. Legislative limitations on certain health care insurers

In 2000, the California Legislature passed a bill placing limits on contractual liens of certain health care insurers. [Civil Code § 3040] The limitations apply to Kaiser [Civil Code § 3040(a)(2)], HMO and insurance carriers. [Civil Code § 3040(b)] Attorneys fees and costs are allowed under a common fund deduction. [Civil Code § 3040(f)]

§ M4:3. Made Whole Rule in California

The made-whole rule is a rule that protects first-party insurance policy insureds from insurer reimbursement claims after a recovery from a third party tortfeasor.

The made-whole rule is a common law principle that limits the insurer’s reimbursement right in situations where the insured has not recovered his or her ‘entire debt’. The rule precludes an insurer from recovering any third party funds paid to the insured until the insured has been ‘fully compensated for his or her injuries’. [21st Century Ins. Co. v. Superior Court, 47 Cal. 4th 511, 519, 98 Cal. Rptr. 3d 516, 213 P.3d 972 (2009)]

Rule usually applies to under-insurance

California courts recognize a made-whole rule when, typically due to under-insurance, the tortfeasor could not pay his or her ‘entire debt’ to the insured: ‘The general rule is that an insurer that pays a portion of the debt owed to the insured is not entitled to reimbursement on that portion of the debt until the debt is fully discharged.” [21st Century Ins. Co. v. Superior Court, 47 Cal. 4th 511, 519, 98 Cal. Rptr. 3d 516, 213 P.3d 972 (2009) (rule applies to automobile insurance policies)]

When an insurance company pays out a claim on a first-party insurance policy to its insured, the insurance company is subrogated to the rights of its insured against any tortfeasor who is liable to the insured for the insured’s damages. [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 272, 37 Cal. Rptr. 3d 434, 444 (3d Dist. 2005)] To preserve its right of subrogation, the insurance company must either interplead itself into any action brought by the insured against the third party tortfeasor, or wait to seek reimbursement under the language of its policy from its insured to the extent that the insured recovers money from the third party. See § M31 MEDICAL PAY REIMBURSEMENT TO FIRST PARTY AUTOMOBILE INSURER; § S105 SUBROGATION (PROPERTY POLICY) [Insurer’s right to recoup payments directly from the insured’s recovery; right of insured to be “made whole”].

It is a general equitable principle of insurance law that absent an agreement to the contrary, an insurance company may not enforce a right to subrogation until the insured has been fully compensated for his or her injuries, that is, has been MADE WHOLE. [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 274, 37 Cal. Rptr. 3d 434 (3d Dist. 2005)]

§ M4:3.01 Reserved

§ M4:3.02 Reserved

§ M4:3.03 Attorney’s fees incurred by insured in recovering third party personal injury damages from a tortfeasor is not included in the made-whole rule

The made-whole rule does not require the insurer to pay for attorney’s fees in personal injury actions. [21st Century Ins. Co. v. Superior Court, 47 Cal. 4th 511, 527, 98 Cal. Rptr. 3d 516, 213 P.3d 972 (2009)] The auto liability insurance company has not been paid a premium to bear responsibility for the entire amount of attorney’s fees and costs the insured needs to spend in order to recover third party personal injury damages. [21st Century Ins. Co. v. Superior Court, 47 Cal. 4th 511, 527–528, 98 Cal. Rptr. 3d 516, 213 P.3d 972 (2009)]

If however the third party personal injury recovery includes recovery of medical payments (e.g. $1000 med-pay coverage paid during litigation) the insured is entitled to a prorata reduction in repayment of the $1000 medical payments made pursuant to an existing reimbursement provision. [21st Century Ins. Co. v. Superior Court, 47 Cal. 4th 511, 527–528, 98 Cal. Rptr. 3d 516, 213 P.3d 972 (2009)] As described by Justice Kennard in her concurring opinion, medical payments coverage is not legal-expense-coverage. [47 Cal.4th 511, 528]

§ M4:3.1. “Agreement to the contrary”; Illustration

There is authority that language in an insurance policy that grants the insurance company all rights of recovery to the extent of its payment overrides the common law MADE-WHOLE RULE. [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 274, 37 Cal. Rptr. 3d 434, 443–444 (3d Dist. 2005)] To the extent that such a rule in fact exists, any contractual provision that intends to vitiate the MADE-WHOLE rule must clearly and specifically give the insurer a priority of proceeds from the tortfeasor regardless of whether the insured was first made-whole. [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 274, 37 Cal. Rptr. 3d 434 (3d Dist. 2005)]

§ M4:3.2. Illustrations; insufficient reimbursement provisions

A provision in a Progressive automobile insurance policy stating: “Progressive is entitled to all rights of recovery that the insured person to whom payment was made has against another”, and in a separate paragraph stated, “When an insured person has been paid by us under this policy and also recovers from another person, entity or organization the amount recovered, the insured person will hold the amount in trust for Progressive and reimburse to Progressive to the extent of our payment”, said two provisions were insufficient to overcome the MADE-WHOLE rule. The provisions did not state the necessary language that the insurer was entitled to reimbursement and subrogation regardless of whether the total amount of recovery of the insured IS LESS THAN THE ACTUAL LOSS SUFFERED BY THE MEMBER. [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 275, 37 Cal. Rptr. 3d 434 (3d Dist. 2005)] In addition, the policy could have provided that the insured in fact assigned or transferred all rights to Progressive to the extent of the insurance company’s payment as in Travelers Indem. Co. v. Ingebretsen, 38 Cal. App. 3d 858, 865, 113 Cal. Rptr. 679 (2d Dist. 1974). [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 275, 37 Cal. Rptr. 3d 434 (3d Dist. 2005)]

In Sapiano v. Williamsburg Nat. Ins. Co., 28 Cal. App. 4th 533, 538–539, 33 Cal. Rptr. 2d 659 (2d Dist. 1994), the policy contained a reimbursement provision: “If any person or organization to or for whom we make payment under this coverage form has rights to recover damages for another, those rights are transferred to us.” This provision was not sufficient to overcome the made-whole rule [28 Cal.App.4th at pgs. 538–539] for the same reasons discussed above. [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 274–275, 37 Cal. Rptr. 3d 434 (3d Dist. 2005)

§ M4:3.3. Illustration: sufficient to overcome made-whole rule

In dictum, Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 274–275, 37 Cal. Rptr. 3d 434 (3d Dist. 2005) approved the provision in Samura v. Kaiser Foundation Health Plan, Inc., 17 Cal. App. 4th 1284, 1289–1290, 22 Cal. Rptr. 2d 20 (1st Dist. 1993), which states: “Health plan (or its designee) shall be entitled to the payment, reimbursement and subrogation as provided in this section C(1) regardless of whether the total amount of the recovery of the Member (or his or her estate, parent or legal guardian) on the account of the injury or illness is less than the actual loss suffered by the Member (or his or her estate, parent or legal guardian).

§ M4:4. Made-whole rule is an equitable doctrine

The made-whole rule and the common-fund doctrine are both doctrines of equity that limit what the insurance company is entitled to receive in reimbursement from its insured. [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 282, 37 Cal. Rptr. 3d 434 (3d Dist. 2005)]

§ M4:5. Made-whole rule is part of the insurance contract

The made-whole rule and the common-fund doctrine are considered part of the insurance contract. [Progressive West Ins. Co. v. Yolo County Superior Court, 135 Cal. App. 4th 263, 282, 37 Cal. Rptr. 3d 434 (3d Dist. 2005)]

§ M4:6. Amount included within the made-whole rule

Where the insurer foregoes participating in the underlying action against the third party tortfeasor to recover funds paid to the insured by legally responsible third party, but seeks to recover from a settlement of the action between the insured and a third party, the insured need not account to the nonparticipating insurer for more than the surplus remaining in the insured’s hands, after satisfying his [insured’s] loss in full and his reasonable expenses incurred in the recovery. [Plut v. Fireman’s Fund Ins. Co., 85 Cal. App. 4th 98, 104–105, 102 Cal. Rptr. 2d 36 (2d Dist. 2000)] See § S105 SUBROGATION (PROPERTY POLICY) [§ S105:8 Insurer’s options to pursue subrogation when insured sues third party tortfeasor for damages]; § O11 OFFSETS, INSURER’S ENTITLEMENT TO.

Distinction; personal injury, med-pay provision

Plut v. Fireman’s Fund Ins. (2000) 85 Cal.App.4th 98, 104-105, 102 Cal.Rptr.2d 36, discussed above, involved a recovery by the insured against an insurance company in a first party policy suit. See § O11 OFFSETS, INSURED’S ENTITLEMENT TO [§ O11:3]. In 21st Century Ins. v. Superior Court (2009) 47 Cal.4th 511, 527-528, 98 Cal.Rptr.3d 516, discussed in § M4:3.03, supra, the issue was limited to reimbursement of med-pay benefits to the insurer after a personal injury recovery was made on behalf of the insured.. 21st Century applied the common fund apportionment rule regarding attorneys fees to reduce the med-pay reimbursement amount to the insurer. See § C48.04 COMMON-FUND DOCTRINE; § M31 MEDICAL PAY REIMBURSEMENT TO FIRST PARTY AUTOMOBILE INSURER [§ M31:2 Offset or reduction of plaintiff’s attorney fees].

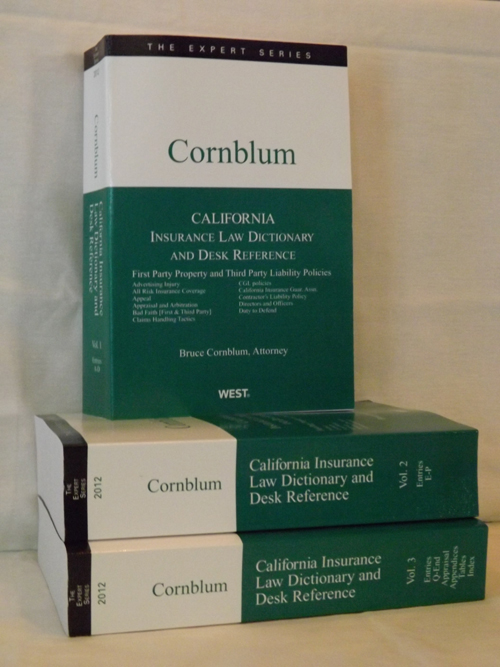

* BOLD references are to Mr. Cornblum’s 2-Volume legal treatise CALIFORNIA INSURANCE LAW DICTIONARY AND DESK REFERENCE. The new 3-Volume 2011 Edition to be published by West Publishing mid-2011. You may purchase the treatise by clicking here.