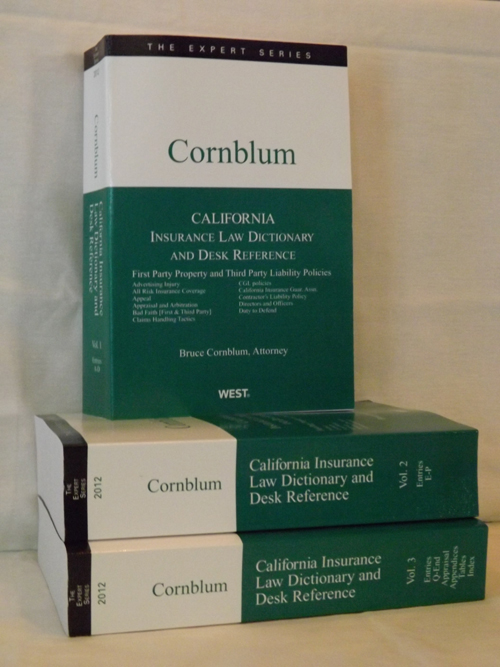

This is the 27th Edition of the DICTIONARY, originally published in 1994. From 1994 the DICTIONARY has grown from a one-volume text of 400 pages to three volumes and over 6600 pages. Before this 2021 Edition the 3-volume text had 2008 separate subject matters. Within these separate subject matters the text cites over 3660 state and federal judicial opinions and over 2800 state and federal statutes and rules. This 27th Edition includes: 1. Reference to six new Supreme Court opinions. 2. Reference to and discussion of 61 Court of Appeal opinions 3. Reference to 34 new words and phrases.

SUPREME COURT DECISIONS:

Between March 2020 and March 2021 the Supreme Court rendered six (6) decisions relevant to the subject matter of this text.

B.B. v. County of Los Angeles (2020) 10 Cal. 5th 1

Regarding the subject of JOINT AND SEVERAL LIABILITY the Supreme Court construed Proposition 51 (Civil Code § 1431.2). The Court held that Civil Code § 1431.2(a) does not authorize a reduction in the liability of intentional tortfeasors for non-economic damages based on the extent to which the negligence of other actors – including the plaintiffs, any co-defendants, injured parties, and non parties – contributed to the injuries in question. See § J2 JOINT AND SEVERAL LIABILITY [§ J2:3.01 Intentional tortfeasors].

Conservatorship of O.B. (2020) 9 Cal. 5th 989

The Supreme Court defined the standard of proof known as “clear and convincing evidence”. The Supreme Court also discussed how an appellate court views a finding of fact proven by “clear and convincing evidence” in determining whether such finding made in the trial court can be overruled. See § C35.002 CLEAR AND CONVINCING EVIDENCE [§ C35.002:1 In general].

Hart v. Keenan Properties (2020) 9 Cal. 5th 442

Hearsay is a singularly important issue as it relates to the proof of a civil action. Hearsay issues appear in matters involving declarations in support of anti-slapp motions and motions for summary judgment, as well as other issues. Compare § A74 ANTI-SLAPP [§ A74:2.09 Insurance coverage; relationship to anti-slapp motions]; § A77 APPEAL [§ A77:9.6.1 Declarations] (discussing the requirement of personal knowledge of facts contained in any declaration).

Ixchel Pharma v. Biogen (2020) 9 Cal. 5th 1130

The Supreme Court discusses the subject of intentional interference with an “at will” contract. See § I61 INTENTIONAL AND NEGLIGENT INTERFERENCE WITH CONTRACT INTEREST OF OTHERS. Intentional interference is relevant in an insurance case involving an insurer’s tortious interference with a protected property interest of its insured [§ I62 INTENTIONAL INTERFERENCE WITH PROPERTY RIGHTS UNDER INSURANCE POLICY [§ I62:1 In general; Fletcher v. Western National Life Ins. Co.], anti-slapp motions [§ A74 ANTI-SLAPP [§ A74:2.05 Examples: causes of action stricken from plaintiff’s complaint].

Montrose Chem. Corp. v. Superior Court (2020) 9 Cal. 5th 215

Excess policies adding additional coverage to a primary policy contains “other insurance” clauses. In multiple disputes involving a large insured-manufacturer that purchased multiple (1) primary and (2) excess policies over a period of multiple years with excess policies collectively providing “other coverage” in a variety of ways, a question exists as to whether such “other insurance” provisions require “horizontal exhaustion” or “vertical exhaustion”. Excess policies were construed to mean that an insured could access its excess insurance whenever it has exhausted the other direct underlying insurance policies that were purchased for the same period. [9 Cal. 5th 215 234] See discussion § O39 OTHER INSURANCE [§ O39:5.2].

Scholes v. Lambirth Trucking (2020) 8 Cal. 5th 1094

Litigation involving the destruction by one party of another party’s trees often occurring with the spreading of a fire onto adjacent property has been a frequently litigated issue. One of the issues is whether the injuries to another’s trees can be doubled pursuant to Civil Code § 3346. Scholes v. Lambrith Trucking, supra, disapproved of prior Court of Appeal opinions which held that negligently spreading of fire is a wrongful injury under Civil Code § 3346, thus permitting doubling the amount awarded. Scholes v. Lambirth Trucking held that Civil Code § 3346 does not provide enhanced damages for injuries to trees from negligently spread fires. [8 Cal. 5th 1094, 1101] See § T47 TREES, WRONGFUL CUTTING [§ T47:2 Duty to defend].

NEW WORDS OR PHRASES ADDED TO THE 27TH EDITION

Thirty-four (34) words or phrases have been added to the 27th Edition. These new words and phrases are:

§ A2.03 ABUSE OF PROCESS

§ A105.02 ATTACHMENT POINT

§ C24.01 CHILDREN; COVERAGE UNDER HOMEOWNERS, AUTO AND CGL POLICIES

§ C27.02 CIVIL AUTHORITY, ORDER OF

§ C35.002 CLEAR AND CONVINCING EVIDENCE

§ C75.01 CONFLICT OF LAW

§ C93.02 CONTEMPT

§ C97 CONTINUING NUISANCE

§ C154.02 CURFEW

§ D46.02 DIRECTED VERDICT

§ E9.04 ELECTRONIC TRAFFICKING DEVICE

§ E12.01 EMPLOYMENT AGREEMENT

§ E55.02 EXISTING LAWS

§ G11.07 GOING AND COMING RULE

§ G15.01 GOOD FAITH

§ G19.02 GRATUITOUS PAYMENT OR REPAIR OF INSURED’S PROPERTY BY A THIRD PERSON

§ H3.03 HEARSAY

§ I31.02 INGRESS, EGRESS PREVENTED BY EXECUTIVE ORDER

§ I66.01 INTERFERENCE WITH CONTRACT

§ J.02 JAMS RULES

§ J12.01 JUDGMENT NOTWITHSTANDING THE VERDICT

§ L9.02 LAW; CHANGE IN THE LAW; EFFECT OF

§ L9.03 LAW: EXISTING LAWS APPLICABLE TO INSURANCE POLICIES

§ L9.04 LAW: UNSETTLED LAW CONCERNING INSURANCE POLICY

§ L27.02 LIABILITY ASSUMED UNDER AN INCIDENTAL CONTRACT

§ M16.01 MARIJUANA

§ N14.01 NEIGHBOR PROPERTY OWNER’S LIABILITY

§ N31.01 NONSUIT

§ P30.03 PERMANENT NUISANCE

§ S9.04 SCOPE OF EMPLOYMENT

§ S14.01 SEEPAGE EXCLUSION

§ S132 SWIMMING POOL

§ T8.02 TENANT’S LIABILITY POLICY COVERING LANDLORD AS “ADDITIONAL INSURED”

§ W20.02 WITHOUT PROPER CAUSE

EXPANDED EXISTING SECTIONS IN THE TEXT

§ A86 ARBITRATION

The importance of “litigating” issues under the arbitration clause continues to be a prominent subject in the appellate courts. New rules of court have been added to the description of the arbitration hearing [§ A86:5.5.1 Evidence at the hearing]. Who decides whether an arbitration clause is proper, i.e. is it the “court” or the “arbitrator”? [§ A86:1.5.1 ] Who decides the issue of unconscionability? [§ A86:1.5] What are the arbitrator’s powers? [§ A86:1.01 Arbitrator’s power at the hearing]

§ B39 BUSINESS INTERRUPTION

COVID 19 has caused extensive nationwide litigation over whether business interruption coverage provides indemnity for the closure of a business after government entities have declared curfews or closures of businesses. See § B39:11 Business interruption coverage; curfew declared by government orders. Several federal district courts have issued rulings. See § B39:12, § B39:15 – 16. The result of these district court opinions depending upon the wording in the business interruption policies. Business interruption coverage differs from policy to policy due to the fact that there exists no industrial standard form for the coverage following an “executive order”.

§ C123 COSTS AFTER JUDGMENT

Whether CCP § 998 is enforceable may depend upon the wording of the offer itself. Also, CCP § 998 offers apply to judgments and awards rendered “after arbitration”. See § C123:2.1 to § C123:3.1. § E55 EXPERT TESTIMONY. Expert testimony can be the basis for a court ruling or arbitration ruling. Expert declarations in summary judgment motions can be controlling. It is for these reasons litigation over whether a declaration of an expert is appropriate or whether an expert is bias and should be disbelieved is a prominent source of litigation. See § E55:2.2; § E55:2.6.03, § E55:19 Bad faith of an expert.

§ F44 FORTUITOUS

The subject of fortuity is an important subject in insurance coverage litigation. See § F44:8 Fortuitous act – are construction and design defects fortuitous?

§ G11 GENUINE ISSUE DOCTRINE

An insurer who is sued for breach of the implied covenant of good faith and fair dealing will proffer a defense that its denial of payment was “reasonable”. See § G11:1. Insurers often attempt to prove a denial was “reasonable” by use of expert testimony [§ G11:1]. A genuine dispute exists only when the insurer’s position is maintained in good faith. [Fadeeff v. State Farm (2020) 50 Cal. App. 5th 94 (summary judgment in favor of insurer, reversed)] See also § G11:1.1.

§ T47 TREE, WRONGFUL CUTTING

The wrongful cutting of trees is a frequent source of litigation. The main issues in such litigation relates to the provisions of Civil Code § 3346 which spells out the amount of damages, referring to double or triple the amount awarded by a jury. The Supreme Court extensively discusses these issues in Scholes v. Lambirth Trucking (2020) 8 Cal. 5th 1094. See § T47:1, § T47:2, T47:3. § U4 UMPIRE. The authority and powers of an umpire have, at long last, been addresses in recent provisions of the California Rules of Court. See § U4:4.1 Umpire’s powers at hearing, § U4:5 Evidence at the hearing, § U4:6 Evidence at arbitration; rules of evidence apply except as described in Rule 3.823(b).

§ U6 UNCONSCIONABILITY

Arbitration clauses inserted in contracts after the enactment of CCP § 1280 et seq. have been a subject of frequent litigation. This is because arbitration became a second “tribunal” for litigating business disputes. A frequent attack made by litigants relates to the unconscionability of arbitration provisions which in most contracts is present without the benefit of knowledge or negotiations of the employee or business customer. The types of agreements that include varying types of arbitration provisions are described in § U6:1.04 Defense of unconscionability can be applied to all contracts. Decisions decided in 2020 included discussions of the “high degree of substantive unconscionability required”. [§ U6:2] The subject of when such provisions are not clear, or are buried in various contract, the “low level of procedural unconscionability” [§ U6:2.02] as well as certain waivers is discussed.

§ U18 UNINSURED MOTOR VEHICLE

Various subjects were discussed in Cal. Rules of Court and appellate decisions in 2020. Arbitrator’s powers at the UM hearing were added to the Cal. Rules of Court [§ U18:11.4.1]. The manner in which uninsured motor vehicle hearings are requested [§ U18:11.1], the manner in which selecting an arbitrator is performed [§ U18:1.1], discovery in arbitration [§ U18:1.2], costs-recovery after UM hearing after prevailing under CCP § 998 [§ U18:11.9] is discussed.

§ V10 VICARIOUS LIABILITY, COVERAGE FOR

Liability of an employer under the “going and coming rule” (nonliability employer) is discussed. [§ V10:1.2]

§ W12 WEAR AND TEAR

Overcoming “wear and tear” defense is discussed in Fadeeff v. State Farm (2020) 50 Cal. App. 5th 94 at § W12:4.

The above are only a few of the words and phrases that have been expanded due to recent decisions of the appellate courts and recent statutory and court rule additions.

Bruce Cornblum

16935 West Bernardo drive, Suite 155

San Diego (Rancho Bernardo), California 92127

Telephone: 858-485-8770

Website: www.cornblum.com

E-mail: cornblum@pacbell.net

Mailing address:

P. O. Box 28536

San Diego CA 92198-0536